Investment fraud is a term that denotes different types of scenarios and practices that scammers use to persuade people to make investments. Basically, they promise people big returns on the money they put in with no risk of losing any of it. Nowadays, these frauds can include everything, from stocks and bonds to currency and real estate.

Understanding that someone is trying to scam you can be difficult because they use different stories and techniques to explain why you should give them the fund. However, whatever the line is, we can say that there are a few different types of investment frauds, and here are some of them.

1. Advance Fee Fraud

This type of scam most commonly targets people who have made some bad investments in the past and now need to get the money to cover their losses. It usually goes like this. A person contacts you stating that they are willing to pay you a lot of money for worthless stocks that caused the problem you are currently facing. However, they say that you need to pay for their services upfront before they do this. When you do this, you will never hear from them again, nor will you get the money back. It is as simple as that.

2. Offshore investing scam

As you can assume, this fraud includes scammers from every part of the world, and it is targeted at people from the United States. This one is also very simple and, in a nutshell, a person will promise you big earnings if you transfer your money to another country, that is, make an offshore investment. This sounds appealing at first because you can avoid paying taxes or at least lower them significantly. Nevertheless, this can cause several problems in the future. First of all, you may have to pay penalties and interests to the government for trying to avoid tax payments. Secondly, in most cases, it is impossible for the authorities to locate the scammers, investigate the fraud, and get you your money back.

3. Ponzi Scheme

This is by far the most famous fraud. A fundraiser attracts new investors by promising big returns on their investments. In some cases, you can earn a profit fairly quickly, but keep in mind that this money comes from the people who have just joined the scheme. When one receives that money sooner than expected, they are more likely to invest significant sums the next time. This can go on for a while, and it usually falls apart when several people ask for their money simultaneously or when a fundraiser cannot attract new investors. When this occurs, and it will, sooner or later, the scammer will disappear with your money for good.

4. Pyramid scheme

Like the previous ones, this type of fraud is also very popular. Nevertheless, it works in a slightly different manner. In this case, investors make money by attracting new people to join and finance the scheme. The more people you get involved in, the more money you make. Once again, you can earn the funds quickly, which usually motivates people to ask others to join. However, it will become impossible to recruit new members at a certain point, which is when the pyramid will collapse.

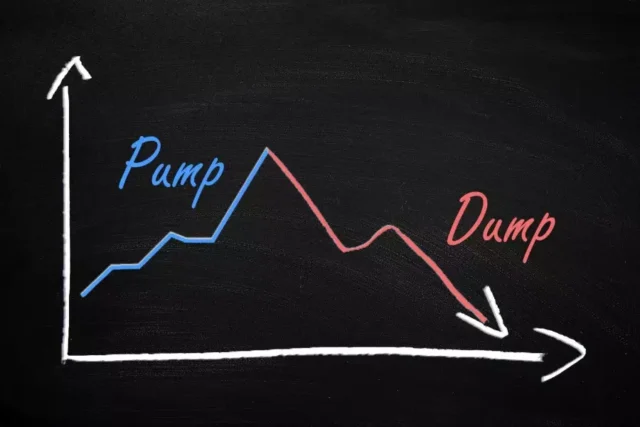

5. Pump and dump scam

When it comes to this fraud, a scammer purchases pretty much worthless stocks, and then they spread false information about them with to goal of alluring investors. They may contact you via a spam email and persuade you to buy these stocks at a low price without you knowing that they actually own these stocks. Once they have enough people interested, the value of the stock rises, and when it hits the peak, they sell the stocks, and naturally, its value plummets. In the end, you are left with nothing.

How to avoid these frauds?

Now that we have introduced you to some of the most popular schemes and explained how they work, let us give you some tips on spotting them and protecting your assets.

The first red flag you need to be aware of is the “guaranteed return with no risks” offer. When it comes to legitimate business, no one can promise you that nothing will go wrong and that you will make a profit. Simply put, if it seems too good to be true, it almost certainly is, and you should forget about it. Furthermore, if you get an offer out of the blue, you need to be careful. As already mentioned, these people usually contact investors via spam emails and phone calls. In addition, they may keep contacting you frequently and tell you that you need to act soon, or you will miss out on the opportunity and that this is once in a lifetime offer. This is a standard method they use to pressure people into giving them money.

Furthermore, you should always talk with an attorney or a professional beforehand. It doesn’t matter what type of investment we are talking about. It is absolutely vital to consult someone before you go through with it. If you want to learn more about the services they offer and how they can help you, you should explore www.mdf-law.com.

Moreover, you need to conduct detailed research. Firstly, when a person contacts you, you should ask them as many questions as you can. Scammers rely on the possibility that you won’t be very interested in learning all the details. It goes without saying that this is how they trick people. Nevertheless, this is the last thing you should do. If the offer appears to be legitimate, you need to investigate it, and you can start by asking questions and then move to learning about the company itself, the products, services, and financial statements.

Finally, never take unsolicited advice from people you do not know. This is especially important if they contact you via social media platforms or spam email. They may tell you to invest in a certain company, but it is probably a pump and dump scam if you cannot find information about it online or if the data you collect is insufficient.