Insurance is often considered a safety net, providing us with peace of mind in times of uncertainty. From health and home to auto and life insurance, these policies are designed to protect our financial well-being.

According to Forbes, at least three out of every four American individuals carry life insurance. Many Americans see life insurance as a way to shield their families from debt. However, insurance policies are not foolproof; they can contain coverage gaps that may leave policyholders (or their families) vulnerable to unexpected financial burdens.

In this article, we will explore the significant consequences of coverage gaps in insurance policies and how they can disrupt your financial security.

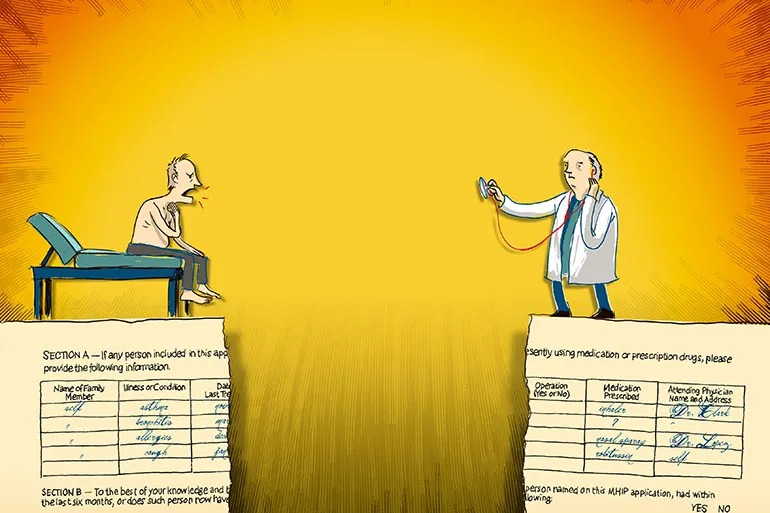

Understanding Coverage Gaps

Insurance policies are complex agreements designed to protect you from financial losses in various aspects of your life. However, these policies are not one-size-fits-all, and it’s essential to comprehend the specific terms and conditions.

Coverage gaps, also known as exclusions or limitations, are the areas where your insurance policy does not provide protection. These gaps can differ significantly from one policy to another, making it crucial to carefully review your coverage and identify potential vulnerabilities.

Seeking Professional Advice

Navigating the complexities of insurance policies can be challenging, and overlooking coverage gaps is a common pitfall. Seek professional assistance from an insurance specialist to safeguard your financial stability.

These experts may assist you in understanding the subtleties of your policies, identifying any gaps, and providing recommendations on how to successfully resolve them.

Their knowledge and experience can be crucial in ensuring that you have comprehensive protection that is tailored to your individual circumstances and requirements. Don’t hesitate to consult with a knowledgeable insurance agent or broker to bolster your financial security through well-informed insurance decisions.

Considering State-Specific Factors

Dealing with insurance agency coverage gaps often requires a deeper understanding of the specific factors that apply to your state. Insurance regulations, requirements, and potential risks can vary significantly from one state to another. Connecticut is one state with its own distinctive insurance landscape.

Situated in the heart of New England, the state of Connecticut is known for its scenic beauty and proximity to the Atlantic Ocean. It faces specific insurance considerations tied to its geographical location and climate. According to Brooks, Todd & McNeil, Connecticut residents need to be mindful of such risks when evaluating their insurance coverage.

CT insurance agencies possess an in-depth understanding of the state’s insurance regulations. They can guide you through the complexities of obtaining the right coverage, offering advice on addressing state-specific gaps and risks. This proactive approach enhances financial security while providing peace of mind.

Auto Insurance Shortcomings

Auto insurance is mandatory in many places, but even comprehensive policies can have coverage gaps. Some of the typical shortcomings include inadequate protection for accidents involving uninsured or underinsured motorists, rental car accidents, or comprehensive coverage for vehicle damage. Failing to address these gaps can lead to significant financial burdens following an accident.

Health Insurance Gaps

Health insurance is vital for safeguarding your well-being, but it often comes with coverage gaps that policyholders need to be aware of. Neglecting these gaps can result in unexpected medical bills and put a strain on your finances, especially during challenging times.

According to the American Safety Council, health insurance often excludes coverage for war injuries, self-inflicted harm, felonies, and drug-related incidents. To obtain maternity coverage in individual health insurance, you might need to pay an extra premium. This coverage can offer a lump sum or a portion of daily hospital room costs for childbirth.

Home Insurance Exclusions

Your home is one of your most significant investments, and home insurance provides a safety net for it. However, home insurance policies often exclude coverage for specific natural disasters like floods, earthquakes, or damage caused by mold. Ignoring these exclusions could mean substantial out-of-pocket expenses for necessary repairs, which could have a severe impact on your financial security.

Life Insurance Limitations

Life insurance policies are designed to provide financial support to your loved ones after your passing. However, these policies can have limitations. Failing to understand these limitations can have devastating consequences for your family’s financial well-being during a difficult period.

Certain conditions and health status may not be policy exclusions but can increase your life insurance premium due to risk factors. According to Bankrate, some common policy exclusions in life insurance coverage include suicide, death during military service, and aviation incidents. Because every insurance provider is different, it’s critical to read your contract to understand your policy’s restrictions.

Closing the Gaps With Riders

To address and mitigate coverage gaps in your insurance policies, consider the use of riders. Riders are add-ons or revisions to your typical insurance policy that give extra coverage for certain circumstances or things that are not normally covered.

For example, you can add an accidental death benefit rider to your life insurance policy. Investigating these choices will assist you in adjusting your insurance to match your specific needs and protect you from unforeseen financial setbacks.

Final Word

The presence of coverage gaps in insurance policies is a critical concern that can significantly impact our financial security. Understanding the intricacies of these policies, seeking expert guidance, and considering state-specific factors are crucial steps in addressing and mitigating these vulnerabilities.

Whether it’s auto insurance, health insurance, home insurance, or life insurance, overlooking these gaps can lead to unexpected financial burdens. The use of riders can offer a customized solution to fill these gaps and provide comprehensive protection.

By proactively addressing coverage gaps, individuals can ensure their financial well-being and achieve greater peace of mind in the face of life’s uncertainties.